is colorado a community property state for tax purposes

Colorado is a common law state not a community property state which means that each spouse is a separate individual with separate legal and property rights. Colorado is an equitable distribution or common law state rather than a community property state.

Income of a nonresident individual for.

. In community property states not only does your spouse have to sign the legal docs but they are also financially responsible for the mortgage regardless of whether or not. Is Colorado A Community Property State For Tax Purposes The. Colorado is not a community property state.

Colorado is not a community property state but it does have a category called marital property in colorado most assets acquired during a marriage are considered marital. Is Colorado a Community Property State for Tax Purposes. Colorado income tax.

Colorado is not a community property state but is whats called an equitable division state. Division of Property Taxation 1313 Sherman St Room 419 Denver CO 80203 Phone. Community income is generated by community property as well as the full earnings of each spouse during the marriage.

On your separate returns each of you must report 10000 of. The conflict between the federal rules governing IRAs and state community property rules recently came to light in a private letter. The state income tax addback.

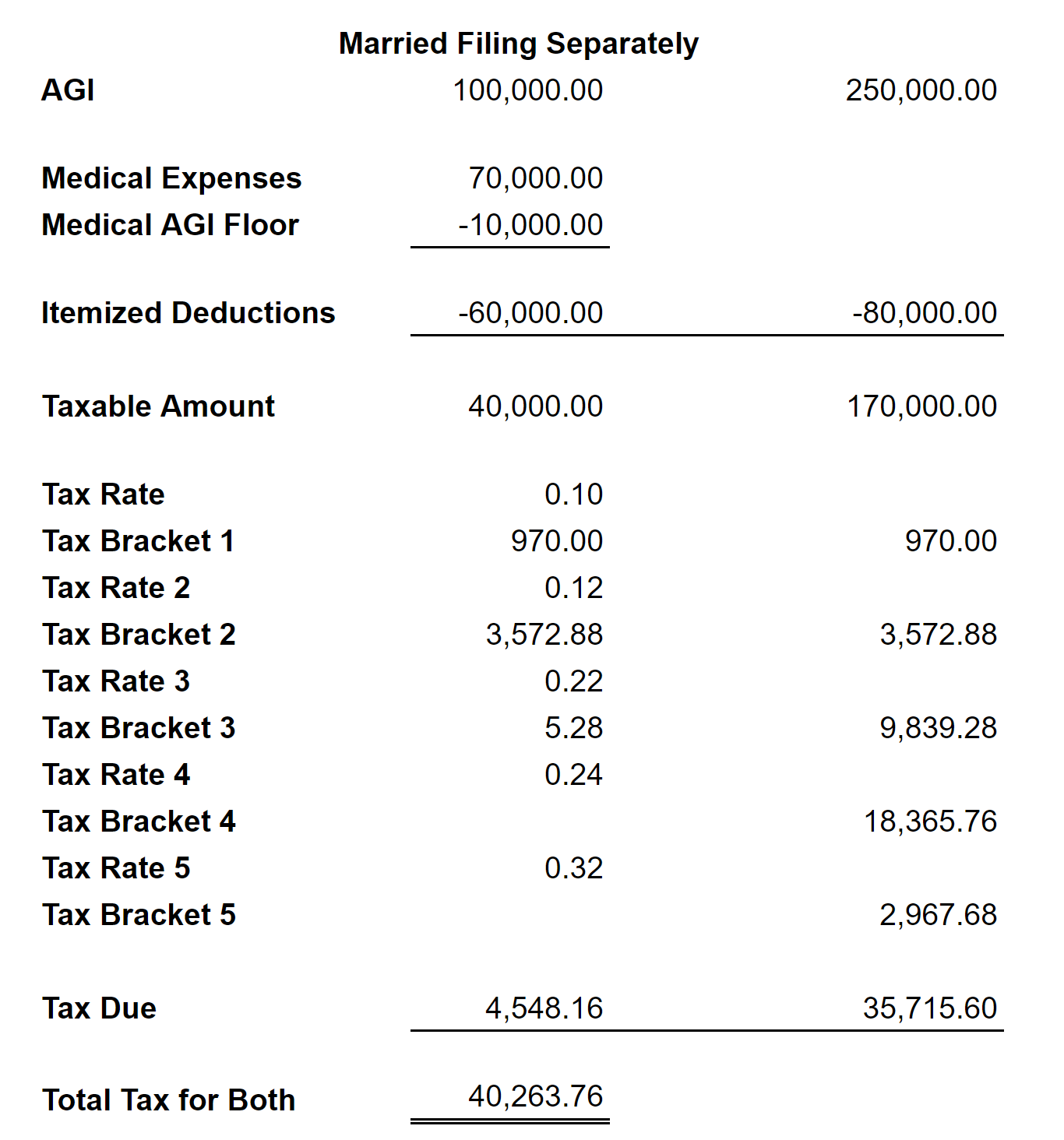

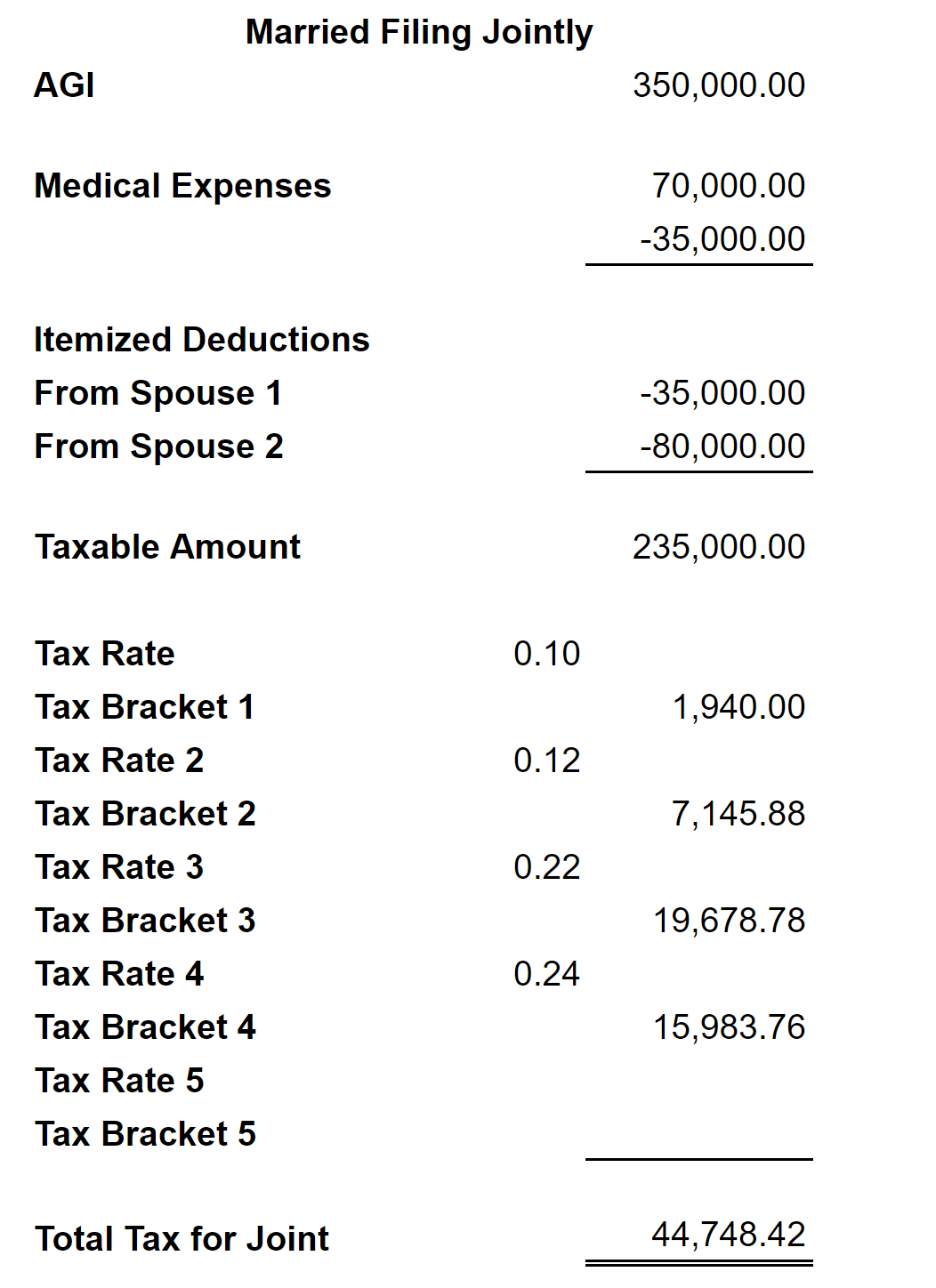

The State of Colorado distinguishes between property and property belonging to the conjugal estate both spouses and separated property belonging to one of the spouses. For income tax purposes if spouses file separate returns each spouse is taxed on 50 of the total community property income regardless of which spouse acquired the income. Under your state law earnings of a spouse living separately and apart from the other spouse continue as community property.

The Colorado use tax rate is 29 the same as the sales tax rate in Colorado and use tax is calculated in the same manner as sales tax. If the item was purchased outside of Colorado. As of 2022 Colorado had a flat income tax rate of 455 of federal taxable income.

Colorado is an equitable distribution or common law state rather than a community property state. Payment of Withholding Tax on Certain Colorado Real Property Interest Transfers. Colorado is not a community property state as courts do not assume that the property obtained during the course of a marriage is all marital property.

The rate was 463 until voters approved Proposition 116 in 2020. If your spouse earns 1000 this week 500 of.

Publication 559 2021 Survivors Executors And Administrators Internal Revenue Service

Can A Married Person File Taxes Without Their Spouse

Community Property Community Property States

Community Property Taxation Laws Ppt Download

Property Tax Calculator Estimator For Real Estate And Homes

Property Tax Calculator Estimator For Real Estate And Homes

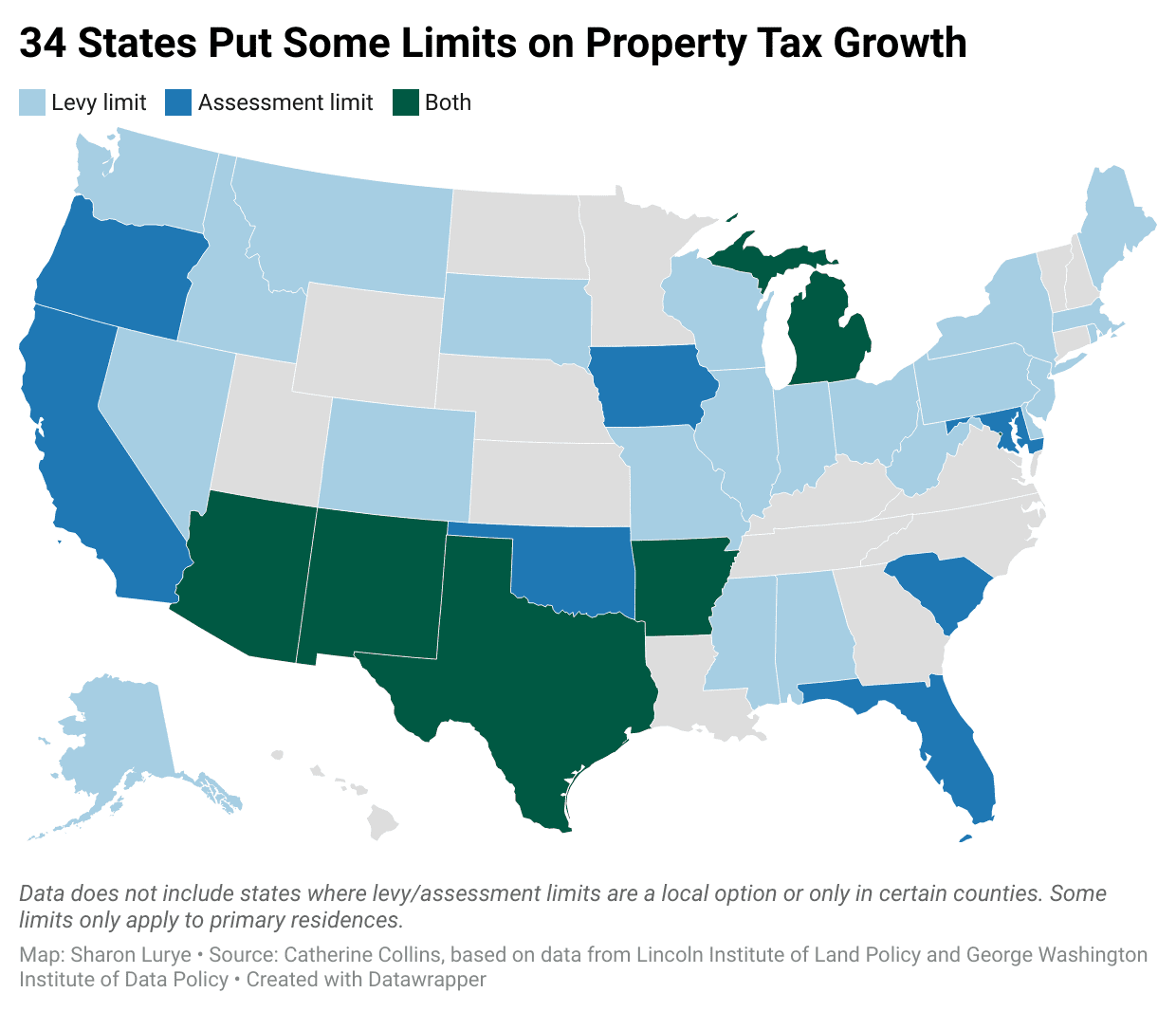

Property Tax In Colorado Post Gallagher What Can Be Understood From Other States Common Sense Institute

Property Taxes By State Highest To Lowest Rocket Mortgage

Can A Married Person File Taxes Without Their Spouse

State Tax Information For Military Members And Retirees Military Com

Estate Planning For Community Property Vs Separate Property

How Taxes On Property Owned In Another State Work For 2022

Is Colorado A Community Property State Johnson Law Group

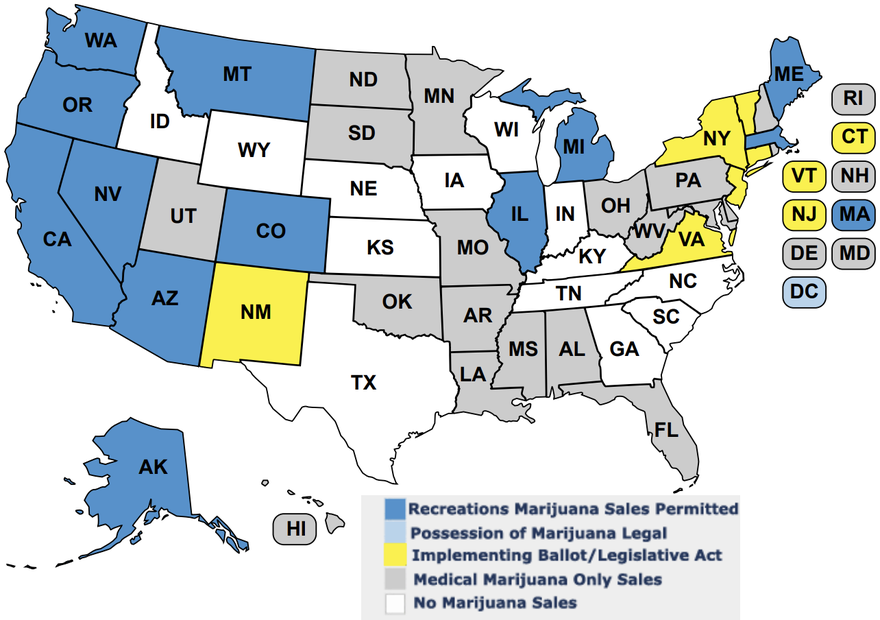

Marijuana Tax Revenue A State By State Breakdown The Motley Fool

1031 Exchanges State Tax Law Considerations

Community Vs Separate Property Difference And Comparison Diffen

:max_bytes(150000):strip_icc()/best-and-worst-states-for-sales-taxes-3193296_final_CORRECTED-4d56f8efcd264f53981a40415c0e6de3.png)